By Michael Rohm, MAI, CCIM, Senior Associate and Director of Valuation Advisory (featured in National Association of Realtors Spring 2023 issue)

We often read about commercial real estate trends such as industrial price appreciation or declining office pricing. But those observations typically fail to recognize that real estate market cycles are specific to submarkets and the distinct property types within those submarkets. Demand could be increasing in a suburban submarket but decreasing in an urban submarket. And in a suburban submarket, Class A office space might be in a completely different phase of the cycle relative to Class B space.

National trends rarely perfectly reflect what’s happening in a given submarket. Nor do they account for the variability of consumer behavior. That’s why we need to be critical of the information we consume and apply to the markets and clients we serve.

Submarkets and property types

As commercial real estate agents, our job is primarily to advise clients and solve problems regarding buying, selling or leasing property. We can be a valued member of a company’s strategic operating process when we are able to provide counsel relative to where pricing and market conditions will be in the next six to 12 months based on historical trends. This could influence the timing of relocation or expansion of, or departure from, a market. Identifying a market’s position in the cycle can also inform:

- Length of time a list price may be relevant

- Absorption rate for new or currently vacant supply

- Sources of future competition

- Capitalization rate that applies to current income

- Expected yield rate in a discounted cash flow analysis

- Expected rent growth or decline during holding period

Power of the consumer mindset

Many external factors influence property value, including interest rates, overbuilding or underbuilding, tax law changes, construction cost changes, population shifts, job creation or loss in a local or regional economy, changes in effective buying power, and market participant psychology.

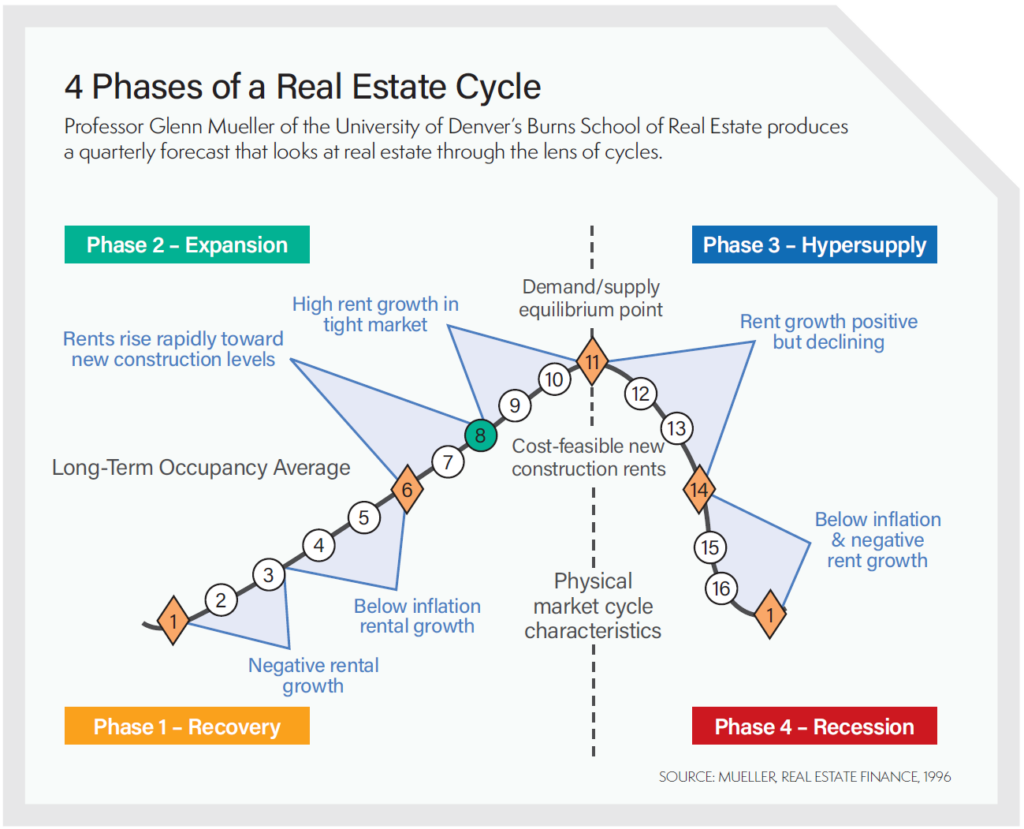

Market psychology arguably affects commercial pricing more than the other factors, essentially driving markets through the four phases of the cycle: recovery, expansion, hypersupply, and recession. Unlike investors in bonds and stocks, however, some commercial property owners prefer to force appreciation through their operating expertise. Therefore, an argument can be made that market psychology influences value-add investors less, because they are always in the market searching for deals.

Nevertheless, buyers’ and sellers’ perception of the market, whether rational or irrational, will influence their decision-making processes. Trends reported by the national media exert the most influence on that perception, even though the reports may have little or no relevance to the property type or submarket.

Physical and capital markets

Two markets influence the cycle: the physical market and the capital market.

- The physical market analysis answers the question How much demand is there for space among users?

- The capital market analysis answers the question How much demand is there for investment properties among investors?

Factors that affect the physical market are changes in employment, population growth and effective buying power. The physical market is defined by the interaction between users (demand for space) and developers and owners (supply of space) in an individual market. Except for residential property types, the physical market is influenced by demand among businesses. An individual business’s space requirement doesn’t always align with the overall market trend for that property type in that submarket. For instance, the office sector may be overbuilt in a submarket in which multiple companies are breaking ground on an office development during a recessionary or recovery period when building is not financially feasible.

Factors that affect the physical market are changes in employment, population growth and effective buying power. The physical market is defined by the interaction between users (demand for space) and developers and owners (supply of space) in an individual market. Except for residential property types, the physical market is influenced by demand among businesses. An individual business’s space requirement doesn’t always align with the overall market trend for that property type in that submarket. For instance, the office sector may be overbuilt in a submarket in which multiple companies are breaking ground on an office development during a recessionary or recovery period when building is not financially feasible.

For most commercial real estate asset classes, the physical market is incredibly inefficient, as a lack of transactional data precludes the analyst from determining the state of the market cycle in real time—a condition known as inefficient price discovery. Simply put, with most commercial real estate property types, there are typically insufficient sales of a particular property type in a given submarket during a short period of time to substantiate how pricing for the property type is trending. Contrast that with market pricing in the residential market cycle and the stock market; both exemplify efficient price discovery, which is based on plentiful transactions and timely data. Furthermore, shifts in commercial real estate pricing generally occur over a long time, because buyers and prospective tenants are accustomed to benchmark values or metrics in a given submarket. These benchmarks are reimagined over time, taking into account outlier transactions that we retroactively understand as the beginning of market shifts. Only in hindsight can we recognize that these once-outlier transactions were the start of a larger market trend.

In the capital market, vehicles such as bonds, stocks, mutual funds, venture debt and hedge funds compete with real estate investment. Real estate uniquely benefits from depreciation write-off and is uniquely diversified in that the return of and on capital can come from increasing net operating income in the physical market or price appreciation in the capital market. For these reasons, many allocate a portion of their holdings to real estate.

The essential role of buyer confidence

Ultimately, three factors motivate many commercial real estate transactions:

- Personal or collective investment criteria

- Tax implications

- Individual space requirements

These factors are specific to each market participant making a purchase or sale decision. Individual transactions are defined as investment value, a concept distinct from market value, which is what appraisers analyze in most circumstances.

In the realm of commercial real estate, market value can be loosely defined as a range of potential sale prices evidenced by at least two similar transactions. These transactions are sometimes few and far between, and their buyers may be motivated by different factors. In this way, pricing is more of a reaction to consumer dependence as a result of individual space or investment needs at a specific time rather than robust data that supports a list or sale price. A more appropriate way to analyze commercial real estate markets may be to characterize patterns as “behavioral cycles” rather than “market cycles.”

Whether you’re analyzing the physical or the capital market, remember that pricing for most commercial real estate assets is relatively inconsistent, depending on the specific buyer’s or seller’s motivation. Therefore, consider the factor of consumer confidence. If enough people believe property values for a certain property type will increase or decline by 20%, the trend is likely to occur, regardless of whether the perception is rational. Real estate markets are driven by emotion and the fear of missing out. When the economy is good, optimism will influence negotiations to result in higher sale prices. In poor or volatile economic times, pessimism will influence negotiations to result in lower sale prices. If fundamental analysis reveals the anticipated pricing expectations are irrational, real estate agents can advise clients accordingly to capitalize on irrational market behavior.

Differences of opinion make the market, and perceived value is sometimes more important than the fundamental relationship between supply and demand. As real estate agents, we are trying to balance historical pricing trends with current consumer behavior, which is often unpredictable and always uniquely motivated. Nevertheless, we need to consider the whole picture to provide sound counsel—even in the face of chaotic markets.